Differences in Inflation Rates Between Two Countries Can Explain

Differences in inflation rates between two countries can explain Long-run changes in the exchange rate but not short-run changes When a currency is described as overvalued this implies. A Explain well short run changes in the exchange rate but not long run changes.

Inflation And Exchange Rates Economics Help

Inflation differentials can be explained under two underlying factors.

. Changes in the exchange rate in both the short run and the. It just suggests that different rates of inflation in the two countries cause the exchange rate to change. Short-run changes in the exchange rate but not long-run changes B.

This page provides a tool that allows everything of the above in a very flexible and reusable way. Therefore UK goods become less competitive. C Changes in the real exchange rate over the long run but not changes in the nominal exchange rate.

One of the problems was Click card to see definition the value of the won fell by more than half compared to the US. High inflation in the UK means that UK goods increase in price quicker than European goods. B Explain changes in the real exchange rate over the long run but not changes in the nominal exchange rate.

As the inflation rate differential increases in favor of the foreign country that countrys goods become more and more expensive. Inflation Comparison Chart Type Match data series by Notes. Figure 91 graphs the inflation rate by country for the 1973-94 period.

34 Principles of Economics TextbookMediaPremium 2399. To make an apples-to-apples comparison we must first convert the 800 into US. Earlier research has examined this topic but it has considered only some of the factors that might be empirically important determinants of inflation rates.

According to CNB real exchange rate is. The highest average inflation rate in the sample is 127 Bra-. The Fed generally tries to keep inflation within the 2-3 range.

Differences in inflation rates between two countries can explain a Short-run changes in the exchange rate but not long-run changes b Changes in the exchange rate in both the short run and the long run c Changes in the real exchange rate over the long run but not changes in the nominal exchange rate dLong-run changes in the exchange rate but not short-run changes. Defined as difference between inflation rates of two countries. Differences in inflation rates between two countries can explain.

Differences in inflation rates between two countries can explain. High-interest rate countries experience higher inflation rates and so the same uninvested dollar today is worth much less in the future. Although economic theory outlines the relationship between inflation and currency exchange rates actual evidence indicates that this relationship does not hold up in the short term.

International Fisher Effect in Spot vs. Long-run changes in the exchange rate but not short-run changes D. Long-run changes in the exchange rate but not short-run changes.

Differences in inflation rates between two countries can. If the exchange rate was such that the shirt in Germany costs 1500 the PPP would therefore be 1510. Other factors such as economic growth the balance of trade which reflects the level of.

According to relative purchasing power parity RPPP the difference between the two countries rates of inflation and the cost of commodities will drive changes in the exchange rate between the. Changes in the real exchange rate over the long run but not changes in the nominal exchange rate C. Long-run changes in the exchange rate but not short-run changes.

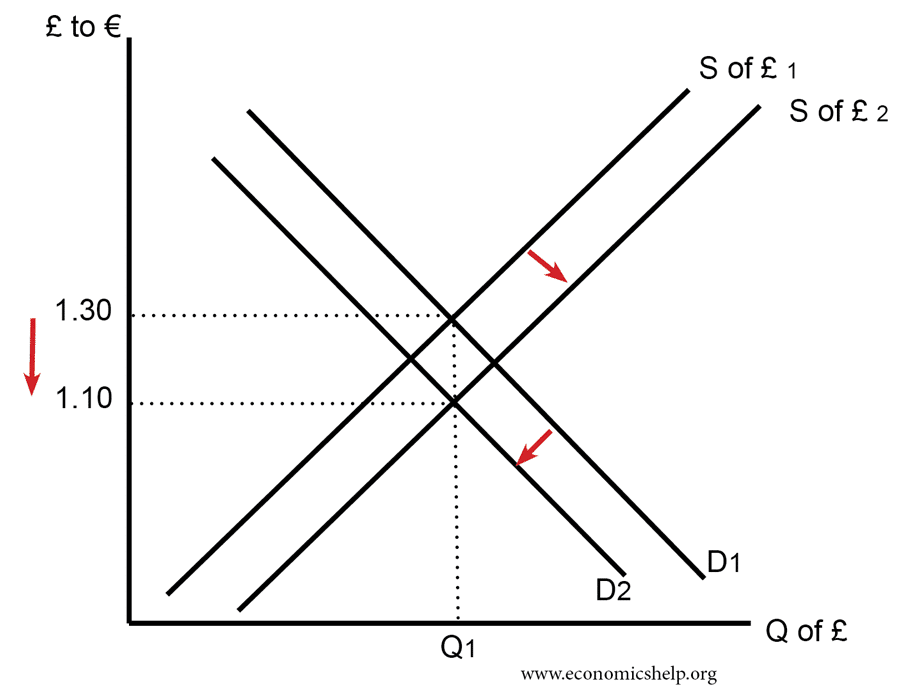

Defined as the ratio of the price level abroad and the domestic price level. A higher inflation rate in the UK compared to other countries will tend to reduce the value of the Pound Sterling because. B Changes in the exchange rate in both the short run and the long run.

The convergence factors and structural difference factors. We consider the distaste for inflation optimal tax considerations time consistency issues. The reason the inflation target is not 0 is that variations around that rate would allow for negative inflation ie.

A Short-run changes in the exchange rate but not long-run changes. How inflation affects the exchange rate. What is inflation differential.

Deflation which is considered disruptive to the smooth functioning of an economy. D None of the above. Inflation is closely related to interest rates which can influence exchange rates.

Sometimes it is required to compare inflation rates between different periods between different countries or even between different countries for different periods. Differences in inflation rates between two countries can explain A. According to the Fisher effect interest rate differences between two countries reflect the difference in the inflation rates of these two countries.

Residents Click again to see term 181 YOU MIGHT ALSO LIKE. Demand for UK exports will fall and therefore. Goods very expensive to Koreans and Korean goods relatively inexpensive for US.

Short-run changes in the exchange rate but not long-run changes. The convergence factors consist of price level convergence and income convergence while the structural differences encompass different levels of inflexibilities in wages different exposure to external economic shocks. This paper attempts to explain the differences in inflation performance across countries.

Changes in the real exchange rate over the long run but not changes in the nominal exchange rate. Purchasing power parity can explain long run movements in exchange rates but does not hold up to scrutiny for short-run changes Differences in inflation rates between two countries can explain. When interest rates are increased to tame inflation foreign capital is usually attracted to the higher rates compared with other.

Its current market value is higher than the value that is. C Explain long run changes in the exchange rate but not short run changes. Perhaps surprisingly given the relative consensus about what determines inflation and about how inflation rates should be set inflation differs substan- tially across countries.

Secondly the theory breaks down completely when there exists various restrictions on trade like tariffs and quotas transport costs exchange control multiple exchange rates etc. In countries like India which is on a path to higher growth the inflation target is 4.

Relationship Between Inflation Rate And Gdp Growth Download Scientific Diagram

Finance Development December 2009 Inflation Drops To Negative Territory

Comments

Post a Comment